How I Navigated Career Change Without Financial Disaster

What happens when you want to switch careers but fear the financial fallout? I’ve been there—staring at my savings, wondering if I could afford the leap. Changing paths isn’t just about passion; it’s about survival. This is how I built a safety net, managed risks, and made the shift without crashing my finances. No jargon, no hype—just real moves that kept me afloat when income slowed and uncertainty hit. The journey wasn’t easy, but it was possible because every decision was grounded in financial discipline and long-term thinking. For many women balancing family, household responsibilities, and personal aspirations, the idea of leaving a stable job can feel overwhelming. Yet, with careful planning and emotional resilience, a career pivot doesn’t have to mean financial collapse—it can become a stepping stone toward greater stability and satisfaction.

The Hidden Cost of Career Pivoting

When most people think about changing careers, they focus on the exciting parts: new challenges, fresh environments, and the promise of better alignment with personal values. What often goes unnoticed are the financial undercurrents that can pull even the most determined individuals off course. A career transition is not just a professional shift—it is a financial project that requires budgeting, forecasting, and contingency planning. One of the most common pitfalls is the income gap. During the period between leaving a current job and landing a new role, cash flow slows or stops entirely. For someone used to a regular paycheck, this gap can stretch for months, especially in competitive fields or when upskilling is required. This interruption affects not only daily living expenses but also long-term obligations like mortgage payments, childcare, and retirement contributions.

Beyond lost wages, there are direct costs associated with retraining and repositioning. Certifications, licensing exams, and specialized training programs can cost hundreds or even thousands of dollars. Some industries, such as healthcare or education, require formal credentials that involve both time and money. Even if the training is completed part-time, the opportunity cost—the income foregone while studying instead of working additional hours—adds up. Additionally, job seekers may face relocation expenses, professional wardrobe updates, or travel for interviews, all of which contribute to the overall financial burden. These expenses are often underestimated or ignored in early planning stages, leading to stress and, in some cases, abandonment of the career change goal altogether.

Another hidden cost lies in delayed career progression. In a new field, even experienced professionals often start at entry-level positions, which means accepting lower salaries and slower advancement. It may take two to three years to reach a comparable income level, depending on the industry. This reality requires a mindset shift—from measuring success by immediate earnings to valuing long-term growth potential. Consider the case of a mid-career marketing manager who transitioned into instructional design. While she brought strong communication and project management skills, she had to accept a 25% pay cut initially. It took 18 months of freelance work and certification before she regained her previous salary. Her success was not due to luck, but to meticulous financial preparation that allowed her to weather the dip without compromising her family’s stability.

Understanding these hidden costs is the first step toward responsible career navigation. It shifts the conversation from “Can I afford to leave?” to “How can I structure this change so it doesn’t destabilize my life?” By treating the transition like a financial endeavor—complete with timelines, budgets, and risk assessments—individuals gain control over the process rather than being at its mercy. This proactive approach transforms fear into strategy, making the leap not reckless, but reasoned.

Building Your Emergency Fund: More Than Just Savings

An emergency fund is often described as a three- to six-month cushion for unexpected events, but for career changers, this rule of thumb may fall short. When stepping into a new field, the period of financial uncertainty can extend well beyond six months, especially if retraining is involved or the job market is tight. Therefore, the emergency fund must be reimagined—not as a temporary buffer, but as a strategic launchpad that supports the entire transition. The goal is not just to survive the gap, but to maintain dignity, reduce stress, and preserve decision-making clarity during a vulnerable time.

To calculate a realistic safety net, start by analyzing fixed monthly expenses: housing, utilities, groceries, insurance, transportation, and any dependents’ needs. Then, add in estimated transition costs such as course fees, certification exams, resume services, and networking events. Multiply the total monthly outflow by the expected duration of the transition—whether that’s nine months, a year, or longer. For example, if monthly expenses total $4,500 and the job search is projected to take 10 months, the emergency fund should cover at least $45,000, plus an additional $5,000 for training and materials. This number may seem daunting, but it provides a clear target and prevents underfunding.

Equally important is how the fund is structured. It should be held in liquid, low-risk accounts such as high-yield savings accounts or short-term certificates of deposit, where money can be accessed quickly without penalties. At the same time, it should not be so accessible that it tempts non-essential spending. Some individuals find success by opening a separate bank account solely for transition funds, labeling it clearly and avoiding linking it to debit cards or payment apps. This psychological barrier helps protect the fund from being eroded by everyday pressures.

For those unable to save the full amount upfront, a phased approach can work. Begin by building a base of six months’ expenses while still employed, then continue contributing during part-time work or freelancing in the new field. The key is consistency and intentionality. One woman preparing to switch from retail management to nonprofit administration built her fund over two years by setting aside $300 per month and redirecting tax refunds. She also reduced discretionary spending by meal planning and carpooling, freeing up extra cash without sacrificing family well-being. Her disciplined saving gave her the freedom to decline a low-paying interim role and wait for a position that matched her skills and values.

The emergency fund is more than a financial tool—it is a source of empowerment. It allows career changers to make choices based on opportunity, not desperation. With a solid foundation in place, the transition becomes less about survival and more about growth.

Income Diversification Before the Jump

Relying on a single income stream during a career change is like walking a tightrope without a safety net. The smarter approach is to diversify earnings before ever leaving a current job. This means exploring side income opportunities within the target field while maintaining stability in the present role. Doing so not only eases the financial burden of transition but also provides real-world validation of interest and aptitude. It’s one thing to imagine enjoying a new career; it’s another to earn from it.

Freelancing, consulting, and gig work offer low-commitment ways to test the waters. For example, someone interested in graphic design can start by creating logos for local businesses or volunteering to design flyers for community events. A teacher considering corporate training might offer workshops to small organizations or develop online courses in her spare time. These activities generate income, build a portfolio, and establish credibility—all while keeping the day job intact. Over time, these side efforts can evolve into a secondary income stream that offsets training costs and reduces reliance on savings.

The key is to identify transferable skills and find ways to monetize them early. Project management, communication, organization, and problem-solving are valuable across industries. A project coordinator in construction, for instance, might use her planning expertise to help small businesses organize virtual events. By packaging her skills differently, she gains experience in event management without starting from scratch. Each paid project strengthens her resume and expands her network, increasing her chances of landing a full-time role later.

Moreover, early income generation provides critical feedback. If a person discovers they dislike the day-to-day tasks of a new field, it’s better to learn that while earning a little than after quitting a stable job. One woman exploring a shift into wellness coaching began offering free sessions to friends and family, then gradually charged small fees as demand grew. When she realized that one-on-one coaching drained her energy more than expected, she pivoted to creating digital content instead. This adjustment saved her from a costly mistake and led her to a more sustainable path.

Income diversification also builds confidence. Earning even modest amounts in a new field reinforces the belief that the transition is possible. It shifts the narrative from “I’m leaving everything behind” to “I’m building something new while still grounded.” This dual-track strategy reduces financial pressure and increases resilience, making the eventual leap far less daunting.

Skill Investment: Spending Smart on Your Future

Upskilling is a necessary part of any career change, but not all investments yield equal returns. The goal is not to spend the most, but to spend wisely—choosing learning paths that deliver credibility, market relevance, and tangible outcomes. Too often, individuals enroll in expensive programs based on marketing hype, only to find the certification carries little weight in the job market. Avoiding this trap requires research, discernment, and a clear understanding of what employers actually value.

Start by identifying the core skills required in the target field. Job postings are a valuable resource—analyze multiple listings to spot recurring qualifications. If most roles require proficiency in a specific software, data analysis, or customer relationship management system, prioritize training in those areas. Free or low-cost online platforms like Coursera, edX, or LinkedIn Learning offer courses developed in partnership with universities and industry leaders. Many provide certificates upon completion, which can be added to resumes and LinkedIn profiles. These options allow learners to gain foundational knowledge without significant financial risk.

When considering paid programs, evaluate the return on investment carefully. Boot camps and intensive certifications can be effective, but they vary widely in quality and recognition. Look for programs with strong job placement records, industry partnerships, and alumni success stories. Avoid those that guarantee employment or promise rapid salary increases—these claims are often misleading. Instead, reach out to graduates directly, ask about their experiences, and assess whether the program led to meaningful opportunities.

Another smart strategy is to leverage existing benefits. Some employers offer tuition reimbursement for courses related to professional development, even if the subject isn’t directly tied to the current role. A woman working in administrative support used her company’s education benefit to take courses in digital marketing, eventually transitioning into a communications role within the same organization. By using employer-sponsored resources, she minimized out-of-pocket costs and gained internal visibility.

The ultimate measure of a skill investment is its applicability. Learning should lead to doing—whether that means building a portfolio, completing a capstone project, or launching a small service. A career changer moving into writing, for example, should produce samples, pitch articles, and seek publication. A future financial advisor should study for licensing exams and practice client scenarios. These actions turn knowledge into proof, making candidates more competitive and confident. Smart skill investment isn’t about collecting certificates—it’s about building capability.

Risk Mapping: Anticipating Setbacks Before They Hit

No career transition unfolds exactly as planned. Unexpected delays, rejections, and lower-than-expected offers are common. Rather than reacting to these events in panic, the best approach is to anticipate them in advance through a process called risk mapping. This involves identifying potential financial disruptions, assessing their likelihood and impact, and creating response plans. It transforms uncertainty from a source of anxiety into a manageable variable.

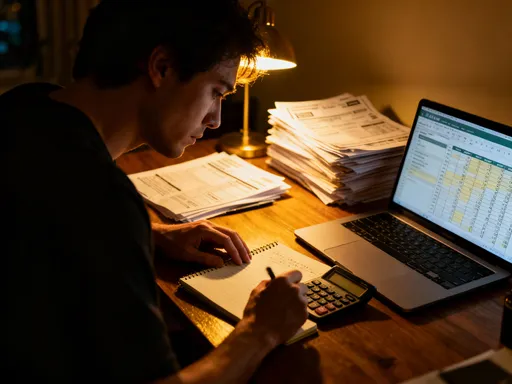

Begin by listing possible setbacks: the job search takes longer than expected, the first offer pays significantly less, relocation becomes necessary, or health issues arise. Assign each a probability and potential financial impact. For example, a six-month job search extension might require an additional $15,000 in living expenses, while a 30% pay cut could mean adjusting the household budget for two years. Once these risks are mapped, develop specific responses. If the job search drags on, could part-time remote work bridge the gap? If the first offer is too low, would temporary freelancing allow for continued searching?

Scenario planning is a powerful tool in this process. Imagine different versions of the future and ask, “What would I do if…?” What if no interviews come in the first three months? What if I need to move for a job but can’t sell my house? Having pre-defined actions reduces emotional decision-making under pressure. One woman preparing for a shift into healthcare administration created a tiered response plan: if she didn’t land a role within six months, she would take a contract position; if that wasn’t available, she would increase her freelance medical writing work. This clarity kept her focused and proactive.

Risk mapping also includes emotional preparedness. Financial strain often triggers self-doubt and family tension. By discussing potential challenges with a partner or trusted friend in advance, individuals can build a support system that provides encouragement, not pressure. Sharing the plan fosters understanding and reduces the sense of isolation that many career changers feel.

The goal is not to eliminate risk—this is impossible—but to manage it with intention. A well-mapped risk plan acts like a financial compass, guiding decisions even when the path is unclear. It ensures that setbacks don’t become derailments.

Leveraging Existing Assets Without Draining Them

During a career transition, it’s easy to view the current job as an obstacle to escape. But in reality, it is a valuable asset—one that provides income, benefits, and access to resources that can support the change. The smartest transitions are not abrupt breaks, but strategic exits that maximize existing advantages without compromising future goals. This means using current employment as a platform, not just a paycheck.

Employer-sponsored benefits are often underutilized. Tuition reimbursement, professional development stipends, and wellness programs can all contribute to a successful pivot. Some companies even offer career coaching or internal mobility programs that allow employees to explore new roles within the organization. A woman in logistics used her company’s leadership training program to develop skills in operations management, eventually transferring to a higher-paying role in supply chain analytics. By staying within the same employer, she avoided income disruption and gained credibility in her new field.

Health insurance is another critical asset. Losing coverage during a transition can lead to high medical costs, especially for women managing family care. If possible, extend employer-based coverage through COBRA or negotiate a phased exit that maintains benefits for a few months. Some individuals choose to leave on the last day of the month to maximize coverage duration. Planning around benefit cycles can prevent costly gaps.

Professional relationships are equally important. Mentors, colleagues, and supervisors can offer advice, referrals, and references. Maintaining these connections with gratitude and professionalism ensures that doors remain open. One woman preparing to leave corporate finance for nonprofit work scheduled informational interviews with former colleagues in the sector, which led to a volunteer opportunity and eventually a paid position. By nurturing her network before leaving, she created a bridge to her next chapter.

The goal is to extract value from the current role without overextending or burning bridges. This balanced approach honors past contributions while paving the way for future growth.

The Mindset Shift: From Stability to Strategic Risk

At its core, a career change is not just a financial decision—it is a psychological one. For many women, especially those responsible for household stability, the idea of stepping into uncertainty can trigger deep anxiety. The comfort of a known salary, routine, and title is powerful. Letting go of that security requires a fundamental mindset shift: from seeking absolute safety to embracing strategic risk. This doesn’t mean being reckless, but rather making intentional choices that align with long-term fulfillment.

Financial uncertainty is inevitable during transition, but it can be reframed as a temporary phase of investment. Just as money is allocated to education or home ownership for future benefit, time and resources spent on career change are investments in long-term well-being. Tracking progress—whether through completed courses, networking milestones, or income from side gigs—helps maintain motivation. Celebrating small wins builds momentum and reinforces the belief that the journey is worthwhile.

Patience is essential. The desire for immediate results can lead to poor decisions, such as accepting a mismatched role just to end the uncertainty. Instead, staying committed to the plan, even when progress feels slow, leads to better outcomes. One woman spent 14 months preparing to move into environmental advocacy. She faced rejections, funding shortfalls, and moments of doubt. But by focusing on incremental steps—volunteering, attending conferences, writing articles—she gradually built credibility and eventually secured a role that matched her vision.

This mindset shift transforms fear into forward motion. It replaces desperation with purpose, and uncertainty with direction. When financial actions are aligned with a clear long-term vision, the transition becomes not just survivable, but empowering.

Turning Risk into Reward

A career change doesn’t have to mean financial freefall. With the right preparation, it can become one of the most empowering financial decisions you make. The key isn’t avoiding risk—but managing it with intention, discipline, and foresight. By building buffers, testing paths, and staying flexible, you don’t just survive the transition—you set the foundation for greater earning potential and personal fulfillment. The journey isn’t about perfection; it’s about progress, one smart move at a time. For women navigating complex life responsibilities, this approach offers a realistic, respectful path forward—one that honors both financial wisdom and personal growth. In the end, the greatest reward isn’t just a new job title, but the confidence that comes from knowing you can reshape your future, responsibly and successfully.